Is There Capital Gains Tax On Crypto . in australia, cryptocurrency is treated as property for tax purposes, which means any gains or losses from buying, selling, or. — other expenses form part the cost base when you dispose of the crypto. — this means that crypto transactions are subject to various tax implications, primarily capital gains tax (cgt). — if you have or are planning to dispose of crypto assets, there are several tax considerations to keep in mind. — as with other cgt assets, if your crypto assets are held as an investment, you may pay tax on your net. how to work out and report capital gains tax (cgt) on transactions involving crypto assets. If you acquire cryptocurrency as. — capital gains tax (cgt) treatment of decentralised finance (defi) and wrapping crypto tokens.

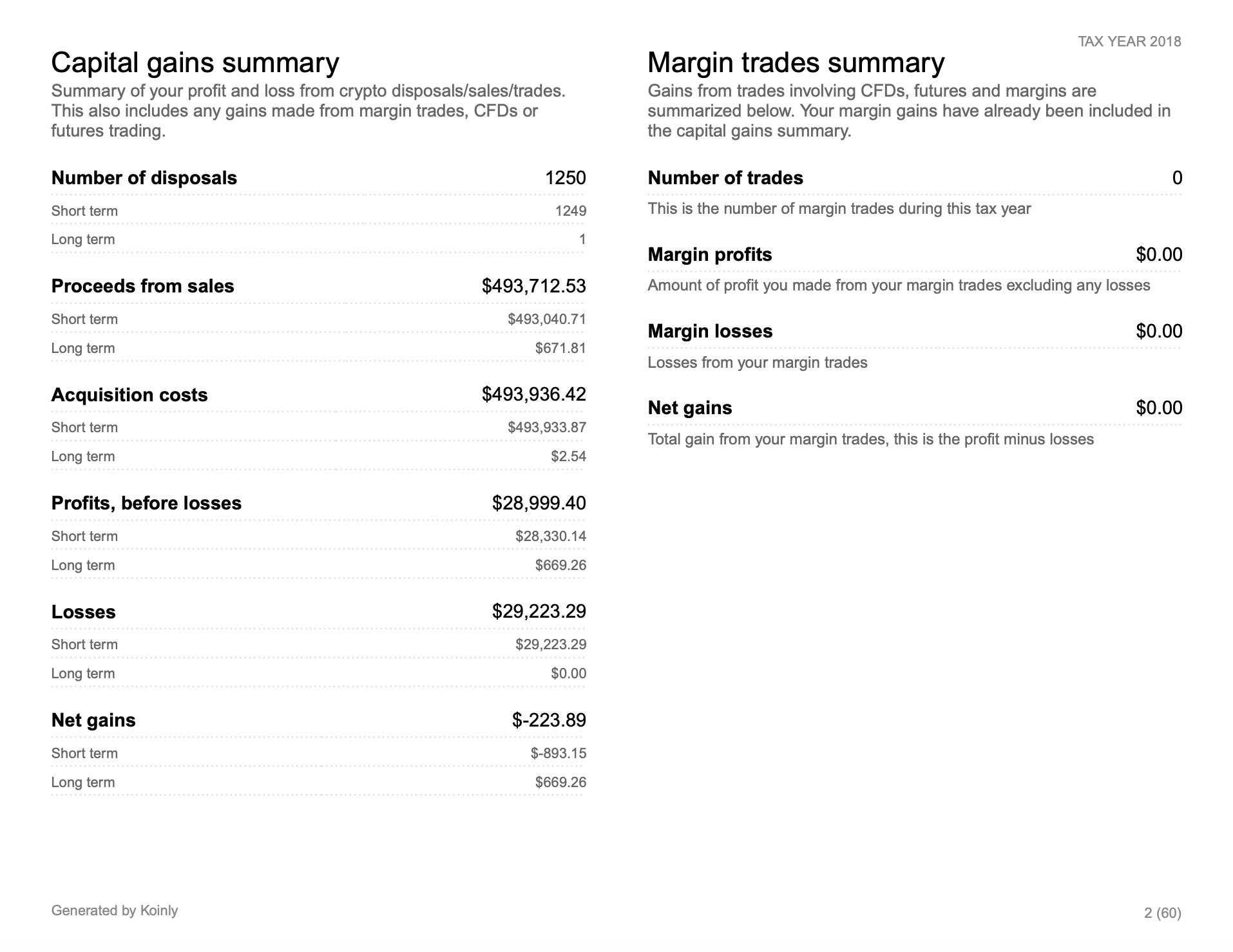

from koinly.io

— as with other cgt assets, if your crypto assets are held as an investment, you may pay tax on your net. — this means that crypto transactions are subject to various tax implications, primarily capital gains tax (cgt). in australia, cryptocurrency is treated as property for tax purposes, which means any gains or losses from buying, selling, or. If you acquire cryptocurrency as. — capital gains tax (cgt) treatment of decentralised finance (defi) and wrapping crypto tokens. how to work out and report capital gains tax (cgt) on transactions involving crypto assets. — if you have or are planning to dispose of crypto assets, there are several tax considerations to keep in mind. — other expenses form part the cost base when you dispose of the crypto.

Crypto Tax Profit and Loss Explained Koinly

Is There Capital Gains Tax On Crypto — if you have or are planning to dispose of crypto assets, there are several tax considerations to keep in mind. — this means that crypto transactions are subject to various tax implications, primarily capital gains tax (cgt). — as with other cgt assets, if your crypto assets are held as an investment, you may pay tax on your net. If you acquire cryptocurrency as. — capital gains tax (cgt) treatment of decentralised finance (defi) and wrapping crypto tokens. how to work out and report capital gains tax (cgt) on transactions involving crypto assets. — other expenses form part the cost base when you dispose of the crypto. — if you have or are planning to dispose of crypto assets, there are several tax considerations to keep in mind. in australia, cryptocurrency is treated as property for tax purposes, which means any gains or losses from buying, selling, or.

From koinly.io

Crypto Taxes USA 2022 Ultimate Guide Koinly Is There Capital Gains Tax On Crypto — as with other cgt assets, if your crypto assets are held as an investment, you may pay tax on your net. — this means that crypto transactions are subject to various tax implications, primarily capital gains tax (cgt). how to work out and report capital gains tax (cgt) on transactions involving crypto assets. in australia,. Is There Capital Gains Tax On Crypto.

From www.taxnodes.com

How to Calculate Capital Gains Tax on Crypto Investments? Is There Capital Gains Tax On Crypto — as with other cgt assets, if your crypto assets are held as an investment, you may pay tax on your net. how to work out and report capital gains tax (cgt) on transactions involving crypto assets. in australia, cryptocurrency is treated as property for tax purposes, which means any gains or losses from buying, selling, or.. Is There Capital Gains Tax On Crypto.

From www.coindesk.com

Crypto Tax 2021 A Complete US Guide Is There Capital Gains Tax On Crypto in australia, cryptocurrency is treated as property for tax purposes, which means any gains or losses from buying, selling, or. If you acquire cryptocurrency as. — as with other cgt assets, if your crypto assets are held as an investment, you may pay tax on your net. — other expenses form part the cost base when you. Is There Capital Gains Tax On Crypto.

From coingape.com

Capital Gains Tax Definition, Rates, Rules, Working Process & More CoinGape Is There Capital Gains Tax On Crypto — this means that crypto transactions are subject to various tax implications, primarily capital gains tax (cgt). — if you have or are planning to dispose of crypto assets, there are several tax considerations to keep in mind. — other expenses form part the cost base when you dispose of the crypto. If you acquire cryptocurrency as.. Is There Capital Gains Tax On Crypto.

From housing.com

Capital Gains Tax Meaning, types, rate, calculation, tips to lower capital gain Is There Capital Gains Tax On Crypto — this means that crypto transactions are subject to various tax implications, primarily capital gains tax (cgt). — if you have or are planning to dispose of crypto assets, there are several tax considerations to keep in mind. — other expenses form part the cost base when you dispose of the crypto. in australia, cryptocurrency is. Is There Capital Gains Tax On Crypto.

From www.youtube.com

Capital Gains Taxes Explained ShortTerm Capital Gains vs. LongTerm Capital Gains YouTube Is There Capital Gains Tax On Crypto — capital gains tax (cgt) treatment of decentralised finance (defi) and wrapping crypto tokens. — this means that crypto transactions are subject to various tax implications, primarily capital gains tax (cgt). If you acquire cryptocurrency as. how to work out and report capital gains tax (cgt) on transactions involving crypto assets. — if you have or. Is There Capital Gains Tax On Crypto.

From blog.commonwealth.com

Understanding the Capital Gains Tax A Case Study Is There Capital Gains Tax On Crypto — if you have or are planning to dispose of crypto assets, there are several tax considerations to keep in mind. — as with other cgt assets, if your crypto assets are held as an investment, you may pay tax on your net. If you acquire cryptocurrency as. — other expenses form part the cost base when. Is There Capital Gains Tax On Crypto.

From koinly.io

Crypto Taxes USA 2022 Ultimate Guide Koinly Is There Capital Gains Tax On Crypto — as with other cgt assets, if your crypto assets are held as an investment, you may pay tax on your net. — capital gains tax (cgt) treatment of decentralised finance (defi) and wrapping crypto tokens. — if you have or are planning to dispose of crypto assets, there are several tax considerations to keep in mind.. Is There Capital Gains Tax On Crypto.

From thebitcoinmanual.com

Capital Gains Tax & Crypto In The UK The Bitcoin Manual Is There Capital Gains Tax On Crypto If you acquire cryptocurrency as. — as with other cgt assets, if your crypto assets are held as an investment, you may pay tax on your net. how to work out and report capital gains tax (cgt) on transactions involving crypto assets. — capital gains tax (cgt) treatment of decentralised finance (defi) and wrapping crypto tokens. . Is There Capital Gains Tax On Crypto.

From taxrise.com

Cryptocurrency Taxes A Complete Tax Guide For All Cryptocurrencies For 2023 • Is There Capital Gains Tax On Crypto in australia, cryptocurrency is treated as property for tax purposes, which means any gains or losses from buying, selling, or. — this means that crypto transactions are subject to various tax implications, primarily capital gains tax (cgt). — capital gains tax (cgt) treatment of decentralised finance (defi) and wrapping crypto tokens. If you acquire cryptocurrency as. . Is There Capital Gains Tax On Crypto.

From www.getearlybird.io

Everything You Need to Know About the Crypto Capital Gains Tax Is There Capital Gains Tax On Crypto — capital gains tax (cgt) treatment of decentralised finance (defi) and wrapping crypto tokens. — if you have or are planning to dispose of crypto assets, there are several tax considerations to keep in mind. in australia, cryptocurrency is treated as property for tax purposes, which means any gains or losses from buying, selling, or. —. Is There Capital Gains Tax On Crypto.

From universalinvests.com

Tax on Capital Gain in Mutual Fund With Examples Universal Invests Is There Capital Gains Tax On Crypto If you acquire cryptocurrency as. — this means that crypto transactions are subject to various tax implications, primarily capital gains tax (cgt). — as with other cgt assets, if your crypto assets are held as an investment, you may pay tax on your net. — capital gains tax (cgt) treatment of decentralised finance (defi) and wrapping crypto. Is There Capital Gains Tax On Crypto.

From www.mydigitalmoney.com

How To Avoid Capital Gains Tax on Crypto My Digital Money Is There Capital Gains Tax On Crypto — capital gains tax (cgt) treatment of decentralised finance (defi) and wrapping crypto tokens. — if you have or are planning to dispose of crypto assets, there are several tax considerations to keep in mind. If you acquire cryptocurrency as. in australia, cryptocurrency is treated as property for tax purposes, which means any gains or losses from. Is There Capital Gains Tax On Crypto.

From cryptotradingclickk.blogspot.com

How To Calculate Crypto Crypto Trade Capital Gain Or Loss You Made Big Money Trading Bitcoin But Is There Capital Gains Tax On Crypto — other expenses form part the cost base when you dispose of the crypto. — this means that crypto transactions are subject to various tax implications, primarily capital gains tax (cgt). — if you have or are planning to dispose of crypto assets, there are several tax considerations to keep in mind. how to work out. Is There Capital Gains Tax On Crypto.

From www.cointracker.io

Paying Tax on Crypto in the UK What to Know About Capital Gains Taxes Is There Capital Gains Tax On Crypto — as with other cgt assets, if your crypto assets are held as an investment, you may pay tax on your net. how to work out and report capital gains tax (cgt) on transactions involving crypto assets. — if you have or are planning to dispose of crypto assets, there are several tax considerations to keep in. Is There Capital Gains Tax On Crypto.

From koinly.io

Crypto Tax 101 What is Cryptocurrency Capital Gains Tax? Koinly Is There Capital Gains Tax On Crypto — as with other cgt assets, if your crypto assets are held as an investment, you may pay tax on your net. how to work out and report capital gains tax (cgt) on transactions involving crypto assets. If you acquire cryptocurrency as. in australia, cryptocurrency is treated as property for tax purposes, which means any gains or. Is There Capital Gains Tax On Crypto.

From www.getearlybird.io

Everything You Need to Know About the Crypto Capital Gains Tax Is There Capital Gains Tax On Crypto If you acquire cryptocurrency as. — as with other cgt assets, if your crypto assets are held as an investment, you may pay tax on your net. — if you have or are planning to dispose of crypto assets, there are several tax considerations to keep in mind. — other expenses form part the cost base when. Is There Capital Gains Tax On Crypto.

From printableawusiloxf.z22.web.core.windows.net

Qualified Dividend And Capital Gain Tax Is There Capital Gains Tax On Crypto — this means that crypto transactions are subject to various tax implications, primarily capital gains tax (cgt). — other expenses form part the cost base when you dispose of the crypto. in australia, cryptocurrency is treated as property for tax purposes, which means any gains or losses from buying, selling, or. If you acquire cryptocurrency as. . Is There Capital Gains Tax On Crypto.